Modern life feels financially tighter than it did a decade ago. Even those with stable jobs and regular income often feel that money disappears faster than expected. In Tekaroid we know well this sensation, and it is not exaggerated. It reflects a deeper transformation in how the modern economy now operates.

The issue is not simply how much things cost, but how money moves through everyday life and how modern economies quietly shape the way we spend. Financial pressure has become such a common feeling in modern societies. To understand why everyday life feels more expensive, it is not enough to look at a single cause. The pressure comes from several changes happening at the same time, often unnoticed on their own but powerful when combined.

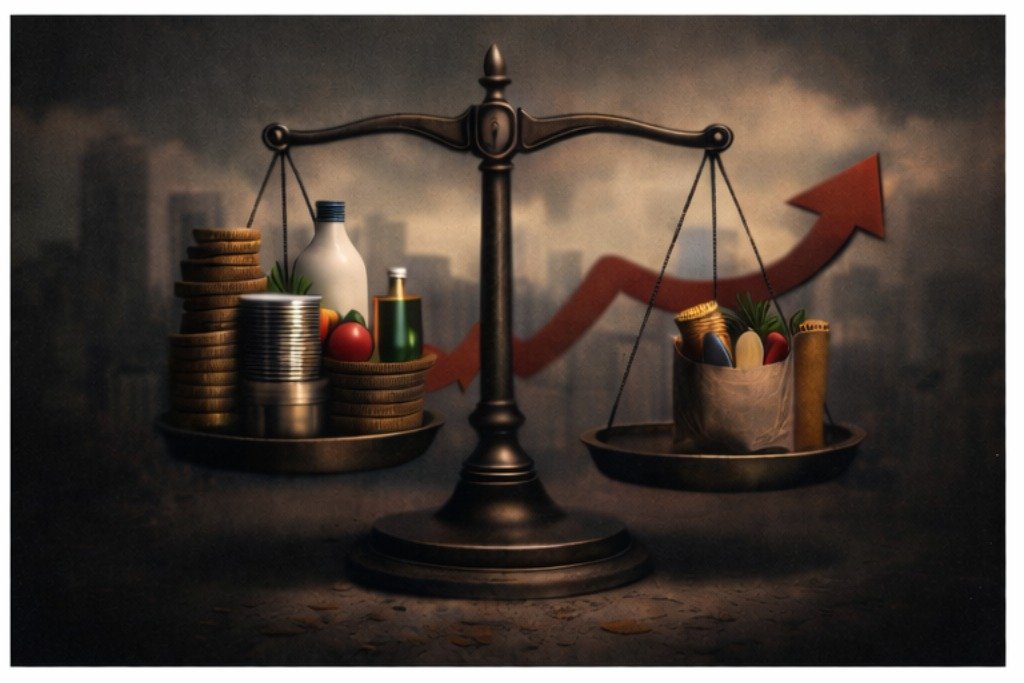

A different kind of inflation

Inflation is often presented as a single number, but everyday experience rarely follows official averages. In practice, price increases affect different parts of life at different speeds. Essential expenses tend to rise first, and once they do, they reshape the entire perception of affordability. At Tekaroid, this distinction matters. When inflation hits what cannot be avoided, it does not just raise prices, it alters financial stability itself.

From an economic perspective, this happens because demand for essentials is inelastic. People cannot easily reduce spending on housing, food, or energy, even when prices rise. These increases are felt more intensely than changes in less essential areas. The inflation we are experiencing today affects all areas of life, it hits the basic pillars of everyday living so hard, it becomes an inflation that is very difficult to avoid.

The subscription effect

Modern consumption has shifted from ownership to limited access. This change has economic logic behind it: recurring payments provide predictable revenue and reduce uncertainty for companies. But for consumers, this shift is more complex, and for individual finances, far more challenging.

Subscriptions rarely feel expensive one by one. Their financial weight comes from accumulation. It is enough to stop and think about how many subscriptions you currently pay for. And even if you have very few, or none at all, consider how many subscription offers you have been exposed to over the past year. How much would your monthly spending be if we accepted paying a subscription, for example, for every small feature on our phones, or for every app we use?

What Tekaroid finds interesting here is not the existence of subscriptions, but how quietly they redefine what a “normal” monthly budget looks like in the digital economy.

Convenience has a price

Convenience is usually presented as progress, and in many ways it is. Technology saves time and makes everyday tasks easier. The business is simple: less time spent, more money paid.

The problem appears when convenience stops being a choice and becomes the default. Once people adapt to faster and easier options, going back feels like a downgrade, even if it means spending less. Convenience turns into an expectation rather than a decision.

Despite the impression of endless choice and constant discounts, prices on the internet are often higher than they seem. Different costs, like delivery or service fees, subscriptions that allow to save money in this costs, and platform charges quietly add up. What looks cheap in isolation becomes expensive when repeated over weeks or months. These small extra costs can create a noticeable increase in yearly spending. Convenience does not usually feel expensive in the moment, but its impact becomes clear when viewed over longer periods.

The pressure point

Housing have become one of the main protagonist in the economy because it is not just another expense. Everyone needs a place to live, but at the same time housing has become an investment. When prices rise faster than wages, the impact is felt across every part of daily life.

At Tekaroid, housing is seen as the core of modern economic stress. Not because rising prices are a new problem, but because for many people, especially in urban economies, avoiding them is no longer realistic. It is not a choice, it is an obligation. The market price of housing is what it is right now, and there is no way to avoid it. In many large cities, this imbalance is easy to see. A single room in a shared apartment can cost almost as much as an entire flat used to cost years ago. Full apartments are often only affordable in areas far from city centres, where transport connections are weak and job opportunities are limited.

Digital payments and spending behaviour

Paying with cash feels very different from paying with a card or a phone. When money becomes digital, spending becomes faster and easier, but also less noticeable.

Without physical cash changing hands, small purchases feel lighter, even if the price is the same. Tapping a card or clicking a button removes the pause that once made people think twice before spending.

This does not mean people are careless with money. It means modern payment systems are designed to make spending smooth and almost effortless. This changes habits, making it easier to spend more without realising it.

Wages and purchasing power

Wages are often discussed in terms of increases, but what really matters is what that money can actually buy. In many cases, even when salaries go up, their real purchasing power does not. This happens because prices rise at the same time, both for essential goods that cannot be avoided and for non-essential expenses that shape everyday life.

As a result, living standards can slowly decline without any dramatic change being visible. On paper, income looks higher. In reality, it does not go much further than before.

At the same time, social media adds another layer. Online, it often looks like everyone is spending freely: travelling, buying new technology, getting tattoos, or constantly consuming new products. This creates the impression that higher spending is normal, even when real purchasing power is shrinking.

At Tekaroid, this gap between appearance and reality is seen as a key reason why financial anxiety has become common today. Not because people are failing, but because rising costs and social expectations move faster than real income.

Fixed costs are taking over

One of the biggest changes in modern life is the growing of fixed monthly costs. A large part of income is now committed before the month even begins.

Rent, utilities, internet, phone plans, transport, subscriptions, and insurance leave little room to adjust spending when prices rise. Unlike occasional expenses, fixed costs do not adapt easily to changes in income.

This reduces financial flexibility. Even small increases in prices can create stress when there is no margin left. At Tekaroid, this shift is seen as one of the reasons why financial pressure feels constant rather than temporary.

The feeling that everything is more expensive is not caused by a single factor. It is the result of multiple changes happening at the same time: rising fixed costs, higher housing pressure, invisible spending, and wages that no longer translate into real purchasing power.